To get unemployment benefits, you need to be financially eligible.

After you apply, to see if you are financially eligible, the government looks at your “base year” to see if:

- you have enough W2 wages; and

- you have at least 18 credit weeks.

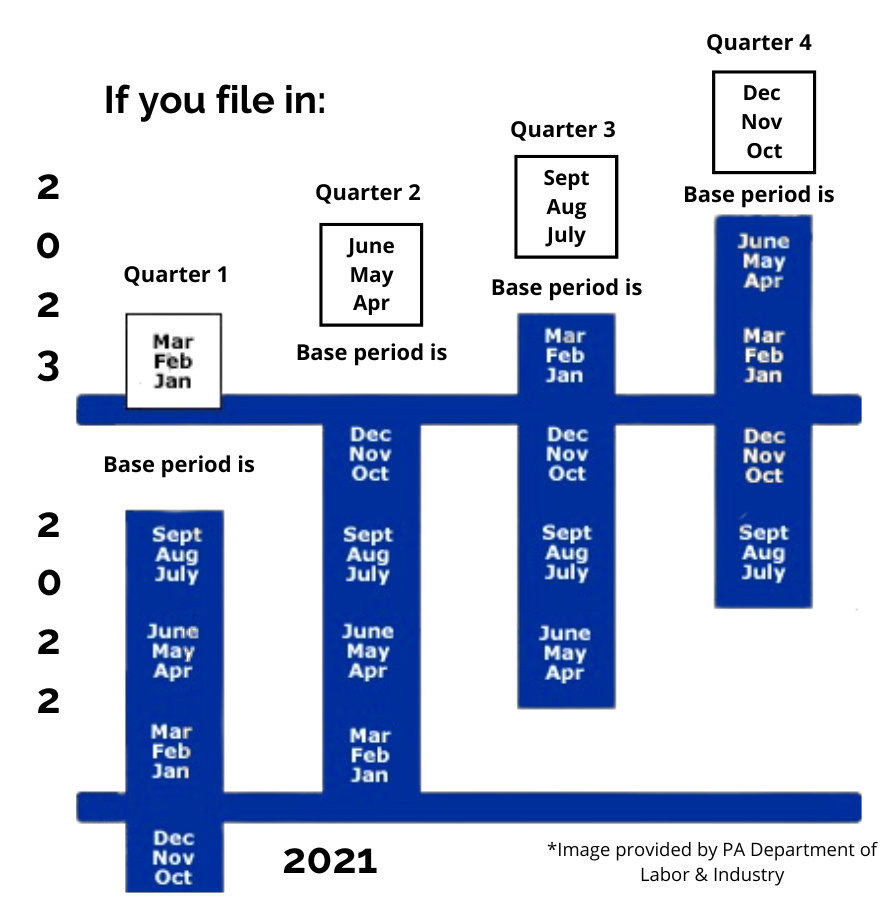

The government divides up the calendar into 4 quarters. Your base year is determined by which quarter you apply for unemployment benefits in.

You can use the diagram below to figure out what your base year is:

A credit week is any calendar week (Sunday through Saturday) in your base year when you earned more than $116.

You can read more about financial eligibility on the Pennsylvania Department of Labor and Industry’s website.

I got a letter that says I'm financially ineligible. What do I do?

The letter should show your W2 wages during your base year. Are there wages missing?

If there are no wages missing, then the letter is correct. You are not financially eligible.

You can reapply for unemployment during the next “quarter” of the year (see the image above to figure out what the next quarter is).

If there are W2 wages missing, file wage protest within the deadline (21 days since the mailing date).

You can file a wage protest by:

- Logging into your UC online account. On your dashboard, scroll down to “Unemployment Services” and click “More Unemployment Services.” Then click “File a Wage Protest.” Fill out and submit the wage protest form. Be ready to upload copies of your W2s or paystubs that show the missing wages.

OR

- Calling the UC Service Center Hotline (888-313-7284), Monday – Friday, 8:00 am – 4:00 pm. Tell the UC representative that you need to file a wage protest.

If you cannot access your UC online account or call the UC Service Center Hotline, you will need to appeal the monetary determination that is missing wages. You can appeal by mail, fax, or email.

In your appeal, include:

- Your employer’s information

- A description of your earnings (how much you were paid, the time period you were paid for, and how you were paid)

- Any proof of earnings (pay stubs, bank statements, etc.)

Are you a gig worker? You need to report your own wages to the government.

My employer paid me in cash or as a 1099 worker, but I'm an employee. My wages are missing from my financial eligibility letter.

Your employer might have misclassified you. If you think this is what happened, you should:

- Appeal the letter within 21 day deadline.

- Provide any proof of your wages/earnings in your appeal.

- Explain why you believe you were an employee.