There are important questions on the weekly certification that you should pay attention to.

You will be asked a series of questions about your work status each time you file a weekly certification.

Below is a guide to help you better understand and answer the questions.

When you first file for Unemployment Compensation and each time you file your weekly or biweekly claims from then on, you will have to report whether you are able to work and whether you are available for work. You are only eligible for unemployment compensation if you are both able to work and available for work.

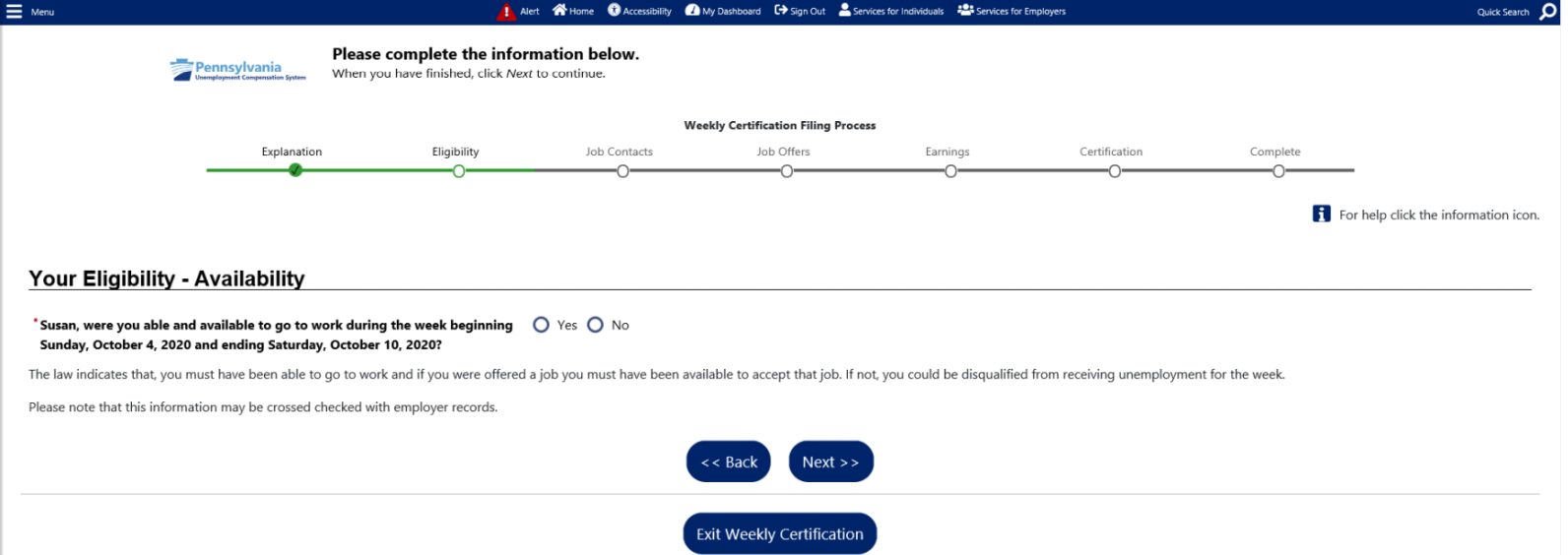

This what the able and available question will look like on your weekly claim:

Being able and available for work means you are mentally and physically capable of working. As long as you would be able to perform some sort of work, if that work was offered to you, you should be able and available. You do not need to be able to do your previous job or any particular type of work. The question is really whether you would be ready, willing, and able to work if you were offered a job. If you could name a job you could do (answering phones, for example), you are able and available.

You do not need to be able to do your previous job or any particular type of work

The reason you must report whether you are able and available each time you file your weekly claim is that your status may change week to week. For example, if you are sick or injured one week, you may not be able and available that week, but when you recover you become able and available again.

Self-Employment or a Sideline Business

When you file, you will be asked if you had any self-employment or increased participation in your sideline business.

For the purposes of UC benefits, there are two classifications of jobs: employment and self-employment. You are self-employed if, in your job, you are (1) “free from direction or control” and (2) “customarily engaged in an independent business, trade, or profession.”

The vast majority of UC claimants are not engaged in “self-employment.”

If you become self-employed while you are receiving unemployment compensation, you will be disqualified from benefits. You will have an opportunity to appeal the disqualification.

Some signs you’re self-employed are:

- You don’t have a supervisor who monitors your work

- You set your own schedule and pay, you use your own tools at work

- You have your own clients (and/or your own business cards), and

- You can subcontract your work.

Usually, people who are engaged in self-employment own their own business or are established independent contractors. However, your employer might refer to you as an independent contractor even though you are actually an employee. For example, the Supreme Court of Pennsylvania recently decided that app-based drivers (such as those who drive for Lyft and Uber) are not self-employed, even though they are treated like independent contractors by their employer.

If you respond “yes” to this question, you will be given an opportunity to provide more information about the new work.

Absence from Work

You will be asked each week if you were absent from work when work was available. This means that if you are currently working, did you turn down a shift or hours that were offered to you during the week.

If you report that you were absent when work was available, you will be asked to report your potential wages, usually the number of hours you missed multiplied by your rate of pay. That amount will then be treated as earned wages, and it may lower your weekly benefit amount (see Reporting Earnings, below).

Your employer will also report this information to unemployment, which they will check against what you enter. It is important to be honest and accurate.

Refusal of Suitable Work

Each time you file, you will be asked if you refused any job offers that week. If you were offered a job and turned it down, you must report it.

You can be disqualified from benefits if you refuse a suitable job offer without good cause. You will be given a chance to explain why you turned down a job before the government makes a decision about your benefits. Answering “yes” will not automatically stop your benefits; your benefits can only be stopped if the government issues a decision finding you ineligible based on the refusal of work.

Reporting Earnings

For each week you file, you will be asked whether you earned wages that week, even if you have not yet been paid. You must report wages earned from any job in any state. It does not matter whether that was the job that you “filed for” when you applied for unemployment.

You can still qualify for benefits when you work part-time. After you file, you will see on the weekly certification chart whether you still qualified for any benefits that week.

However, if you worked your normal, full-time hours, you will not be eligible for benefits for that week.

If you worked, you will be asked to provide information about the job, including the name of the employer, your position, and your rate of pay. Most importantly, you must report the wages you earned.

You must report your gross earnings (before taxes) for work you did each week. If you’re unsure of what your gross earnings should be, the easiest way to calculate them is to multiply the number of hours you worked in the particular week by your rate of pay.

For example, if you are filing for weeks ending June 6 and 13 and you worked 20 hours each week at $9.00 an hour, you would report weekly earnings of $180.00, even if you do not get paid until the end of the month.

Your “potential earnings” are any wages that you actually turned down by rejecting hours of work. “Potential earnings” does not mean money that you would have made if you had a job.

You are also required to report any vacation pay or other paid time off that you receive.

If you think your employer is misleading you about what you need to report, read our resource about employer mistakes and misinformation.

If you earned wages, your weekly benefits will be determined as follows:

Many claimants who work part-time during the week can still qualify for benefits. It depends on how much you made in gross earnings and your Partial Benefit Credit (PBC).

Your PBC is 30% of your Weekly Benefit Amount (WBA). Here’s how you use it to figure out how much of your WBA you will get while doing part time work:

- If you earn less than your PBC, you will get your full WBA.

- If you earn more than your PBC, there will be a dollar for dollar offset.

- If you earn more than your PBC and WBA combined, you will not be eligible for benefits that week.

Here’s an example:

If your WBA is $200, that means your PBC is $60 (that’s 30% of $200). So to figure out what amount of earnings would make you not eligible for benefits, you need to add those two amounts together.

$200 WBA + $60 PBC = $260

This means, in this case, you must have earned under $260 to qualify for benefits.

So, if you earned $100 in a week, you would be eligible for an offset amount of your WBA. To figure out that amount, you just subtract $100 from $260 (the total amount of your PBC and WBA). You would be eligible for $160 of benefits.

If you earned $270 that week, you would not be eligible for any benefits since that is more than the $260 total.

If you earned $50, you would be eligible for your entire WBA ($200) because $50 is less than $60 (your PBC).