Unemployment benefits are federally taxable income.

Unemployment benefits, including UC, PEUC, FPUC, and PUA, all count as income for federal tax purposes. You should receive a 1099-G form in the mail that you will submit with your tax return.

However, unemployment benefits do not count as income for Pennsylvania taxes.

What if the 1099-G I is incorrect?

Some claimants may get an incorrect 1099-G. Below are some common situations where this happens and what you should do in response.

If you never applied for benefits, then you are most likely the victim of identity theft, meaning someone used your identity to claim benefits. You should report the fraud to the PA Department of Labor and Industry here.

When you file your taxes, you do not have to report the income from the 1099-G on your tax return. However, you do need to report the fraud to the PA Department of Labor and Industry as soon as possible.

If you later receive an IRS notice later saying that you owe more taxes because you didn’t report all your income, you should immediately contact the PA Department of Labor and Industry for a corrected 1099-G.

The 1099-G includes payments you received in 2024, even if they were delayed payments for prior claim years.

If you still believe the amount on the form is too high, or if you had applied for benefits but never received payments in 2024, you should:

- Review the payment summary on your portal.

- If you did not receive the payments that have transaction numbers next to them, there may have been an issue with your payment method. You should then contact the UC Service Center.

Frequently Asked Questions

Yes, you do have to report your UC benefits as earned income when you file your 2024 taxes. You will get a 1099-G form in the mail that lists your income from UC, or any of the prior pandemic programs if you received delayed payments from them in 2024.

Philadelphia residents can have their taxes filed for free through the Campaign for Working Families. If you are not a Philadelphia resident, you can find your nearest Volunteer Income Tax Assistance site using the IRS search tool.

There is no need to delay the filing of your 2024 return if you have not already filed.

If you filed your 2024 taxes without including your 2024 unemployment compensation income on your federal tax return, then you will need to file an amended 2024 return with your unemployment compensation income.

If you have a tax preparer, you should ask them to file an amended 2024 tax return that includes your unemployment compensation income. If you do not have a tax preparer and you live in Philadelphia, Campaign for Working Families’ can help you. If you are not a Philadelphia resident, you can find your nearest Volunteer Income Tax Assistance site using the IRS search tool.

Yes, if you select federal withholding in the UC portal, you will have 10% of your benefits withheld each week.

This decision is entirely up to you. Deciding to withhold your taxes depends on whether you prefer to pay the taxes now through withholding or if you want to pay the taxes later when you file your 2025 return in early 2026.

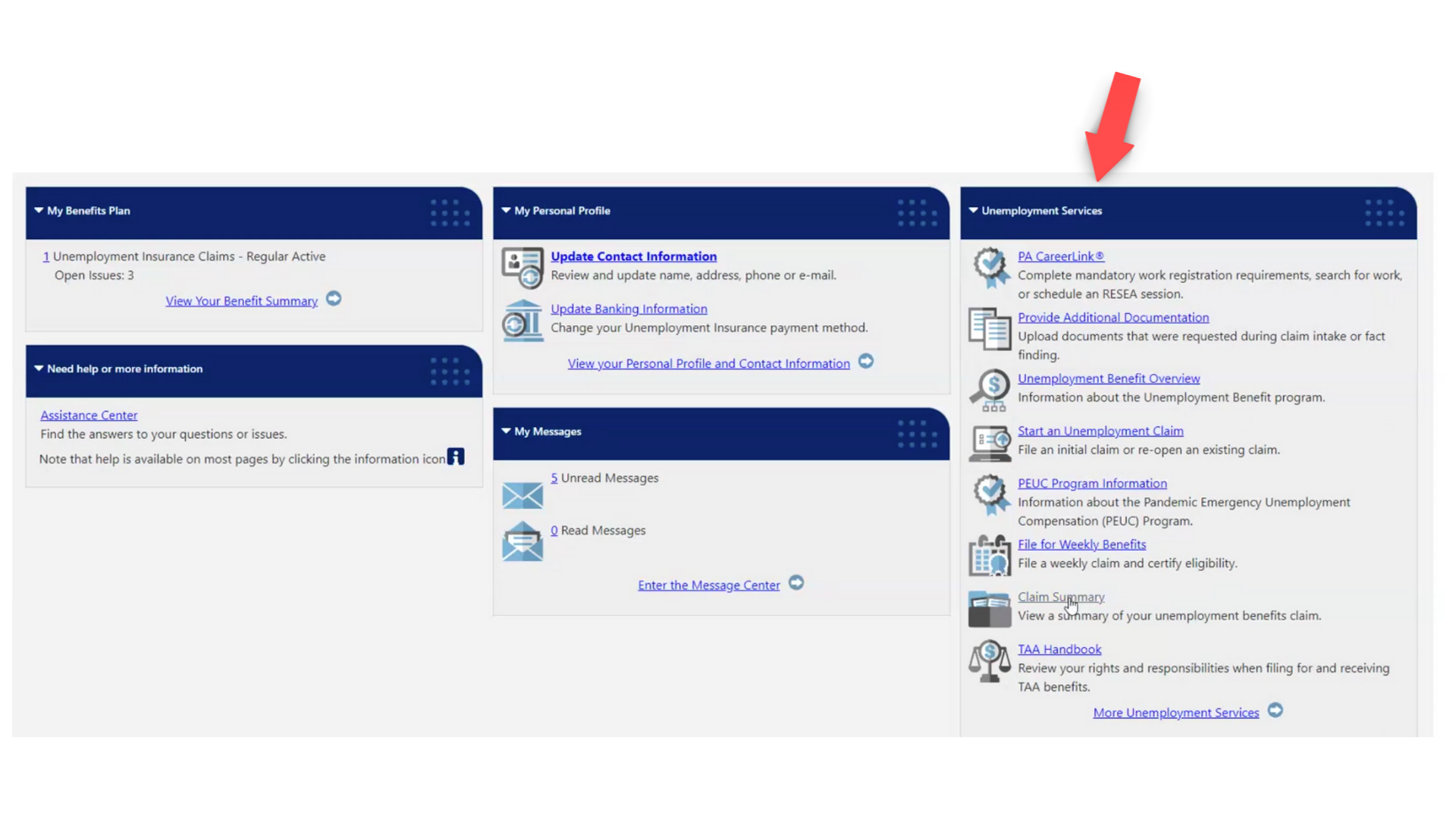

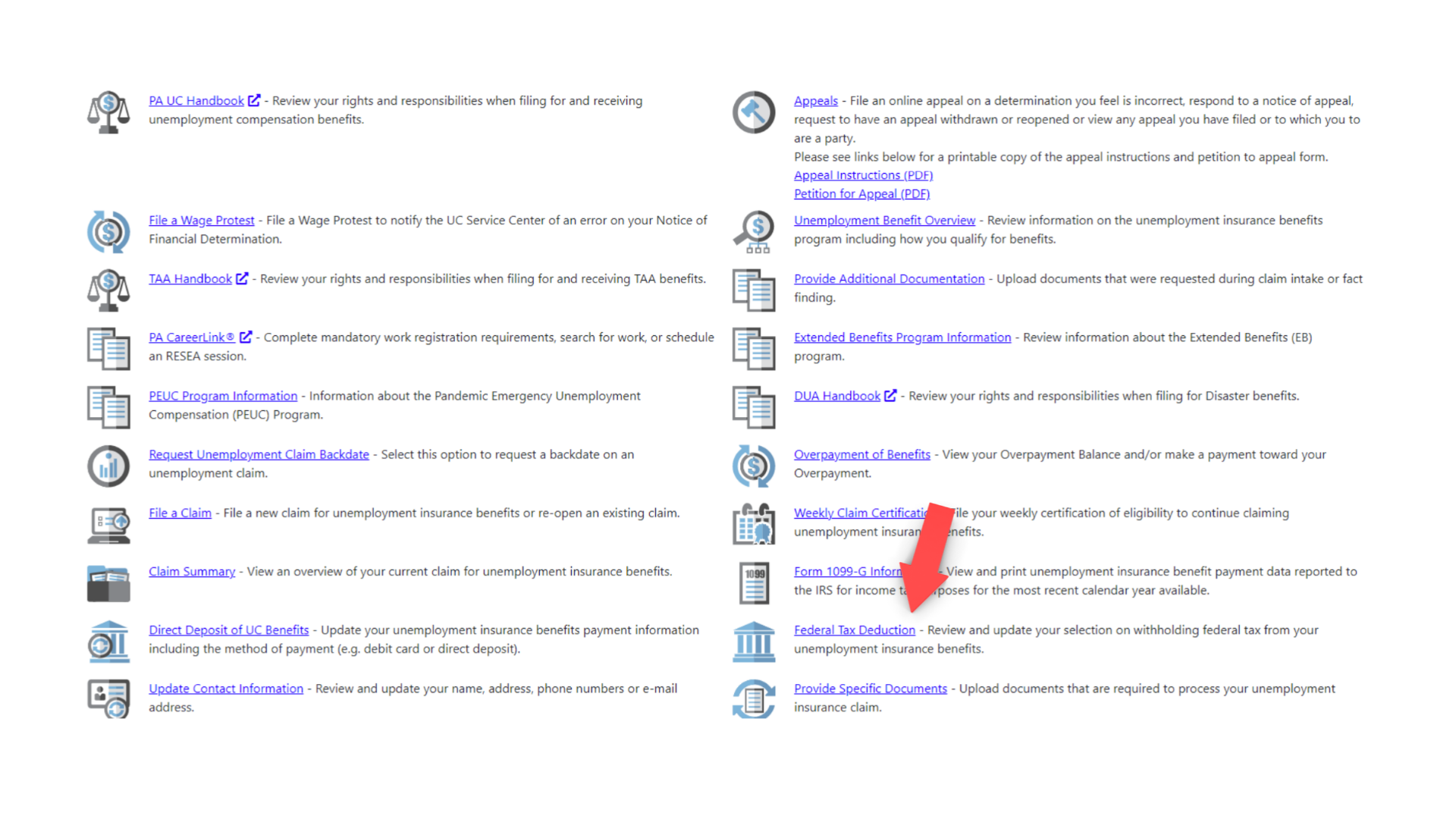

You can change your withholding preference (yes or no) in the online portal for the UC system. You can also call the statewide UC phone number (888-313-7284) and ask a representative to change it.

Where can I change my tax withholding preference?

You can change your withholding preference (yes or no) in the online portal for both the UC system and the PUA system. You can also call the statewide UC phone number (888-313-7284) and ask a representative to change it.